Lately, I’ve heard from several readers stressed out over phone calls they received about student loan consolidation.

The questions are usually the same: Are the calls about consolidation legitimate? Is it a good idea for me to consolidate my loans? How do I know if it is a scam?

The short answer to most questions is pretty simple: Yes, student loan consolidation is a legit process and may help some borrowers. However, the company calling you about consolidation services is probably a scam.

The Rise in Student Loan Consolidation Scam Calls

Student loan borrowers are a great target for scammers.

Managing student loans can be confusing, and it is stressful for many borrowers. Add in the fact that over 40 million Americans have student debt, and you create a situation ideal for abuse.

Robocalls are an especially efficient method of finding potential targets. Scammers can reach huge numbers of borrowers with little effort. They leave a message that is the right mix of scary and overwhelming, and borrowers fall into the trap.

Some scammers even have the audacity to pretend they are the Department of Education.

Legitimate Government Services vs. Student Loan Scams

This site has previously taken an in-depth look at how to identify scams.

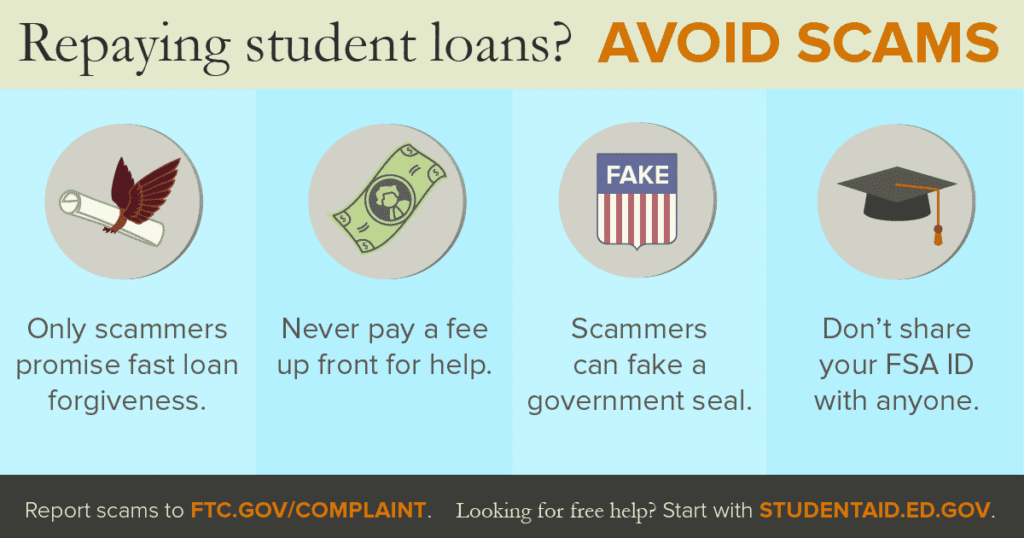

The Federal Trade Commission created a very simple graphic the covers many of the common red flags that borrowers should avoid:

However, it is worth noting that there are many legitimate government services designed to help people with their student loans.

- Federal Student Loan Consolidation – The Department of Education refers to this process as Federal Direct Consolidation. There is no charge for federal consolidation. There is only one place to consolidate federal loans: through the Department of Education.

- Income-Based Repayment – Federal student loans have many repayment plans that calculate payments based upon what a borrower can afford. The Department of Education Loan Simulator is a helpful tool for comparing repayment plan options.

- Student Loan Forgiveness – The important thing to know about federal student loan forgiveness is that it doesn’t cost any money to apply. There is a wide range of loan forgiveness options, but it is likely a scam if you are pressured into applying.

Should I Consolidate My Federal Student Loans?

The decision to consolidate normally doesn’t have an easy answer.

The best way to explain consolidation is that it is a process that converts old federal debt into new federal debt. Consolidation may help borrowers qualify for preferred repayment plans or forgiveness programs. However, consolidation may also hurt eligibility. Whether or not consolidation is a good idea depends upon borrower circumstances and loan details.

This guide to federal student loan consolidation may serve as a solid overview of the considerations for borrowers. Borrowers should also consult their federal student loan servicers to ensure that they are not making a consolidation mistake.

Consolidation vs. Refinancing: Many companies offer private refinancing services. Refinancing can transform federal student loan debt into private student loan debt. Consolidation refers to the federal process, but sometimes private lenders use these terms interchangeably. The important thing to know is that if you want student loan forgiveness or income-based repayment, don’t refinance your federal student loans with a private lender.

Scam Companies that Call About Student Loan Consolidation

In the past, I’ve identified the specific names of companies that were trying to scam borrowers.

Unfortunately, scammers responded with threats of lawsuits and malicious spam attacks. As a one-person operation, I don’t have the resources to deal with these issues.

Fixing a Student Loan Scam?

If you think you may have fallen for a student loan consolidation scam, do not panic.

There are steps borrowers can take to get their money refunded. Additionally, those who catch the scam early enough may be able to correct consolidation issues.