Perhaps the biggest perk with federal student loans is that they have repayment plans based upon how much a borrower earns rather than how much they owe.

These income-driven repayment (IDR) plans include: Income-Contingent Repayment (ICR), Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). There are important differences between these plans, but getting lower monthly payments is done the same way, regardless of the plan the borrower chooses.

Typically the income certification is done by linking to the IRS in order to give the Department of Education the borrower’s most recent tax return. Borrowers looking to get their monthly payments lowered due to a job loss or reduction in income will have to take a few extra steps to make sure the Department of Education has the most updated income information.

Though the process might seem a bit confusing for borrowers who don’t want to use their most recent tax return, the steps can usually be completed in a few minutes.

The Basic Steps to Get Payments Lowered

- Go to Studentloans.gov and click on the link to Apply/Re-Certify/Change an Income-Driven Repayment Plan,

- Sign in and choose the link to “Recalculate my monthly payment”,

- Navigate through the part that requires linking to the IRS, and

- Submit Alternative Documentation of Income

Perhaps the most challenging part of the process is skipping past the IRS linking. (Note: most IDR applicants can simply use the IRS linking procedure to document their income… the borrowers with issues will be the ones who have recent tax returns that show a large income than what they currently make.)

IBR/PAYE/REPAYE/ICR Payments Without Using Most Recent Tax Return

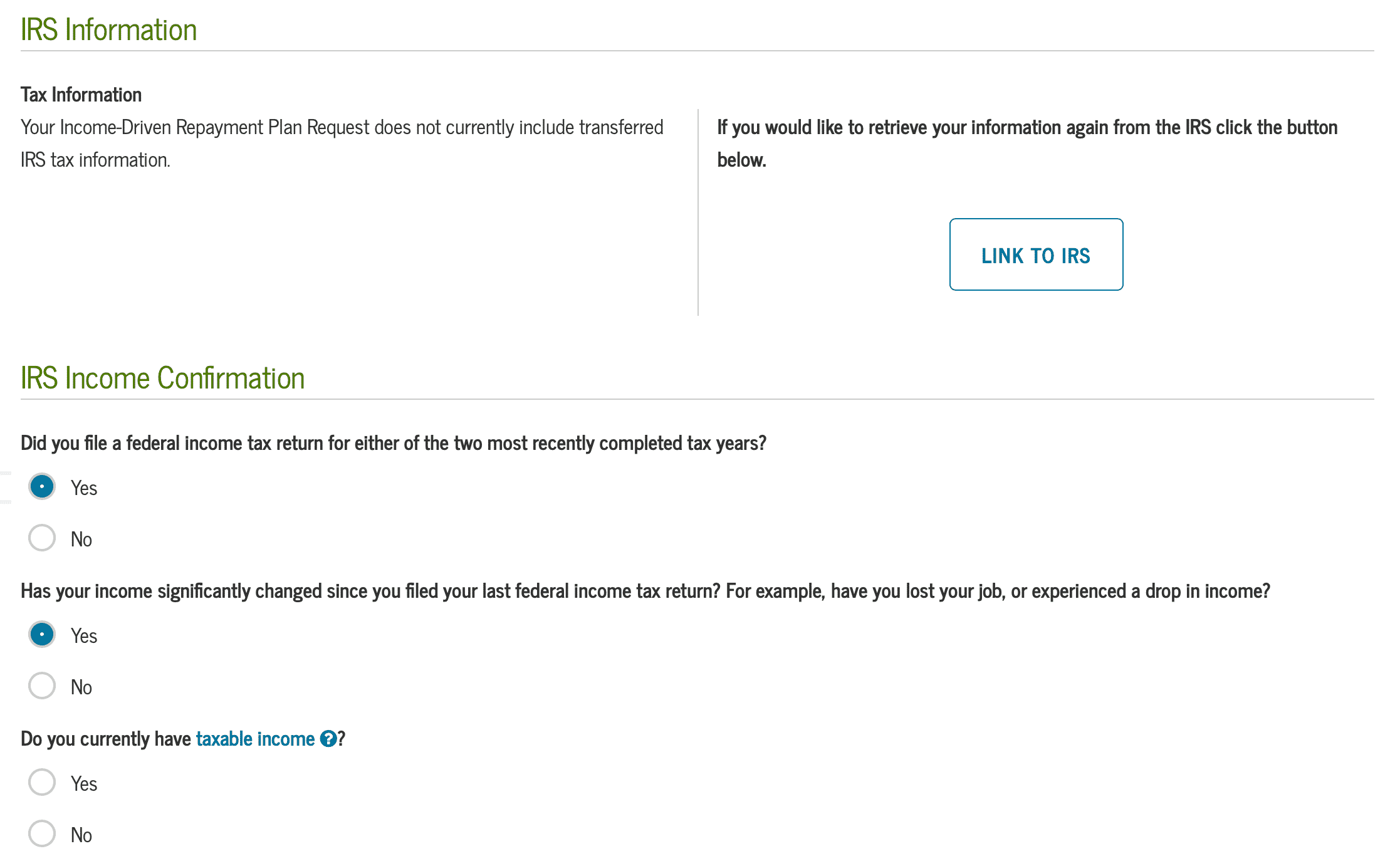

Within the application for payment recalculation, borrowers will get the following screen:

Borrowers who are looking to get their payments lowered due to a job loss or salary cut typically will not be using their most recent tax return. Unfortunately, there doesn’t seem to be an option to skip this step.

Thus, everyone still must click to “Link to IRS.”

From there, applicants are directed to an IRS page. Those looking to submit alternative documentation of income simply need to click on the link to “Return to studentloans.gov.” The tax records import does not have to be completed.

At that point, the Income Information page on the studentloans.gov application will look slightly different.

Borrowers will have the option of selecting a link to show their income has changed significantly since their last federal income tax return. It should look like this:

Borrowers with no taxable income can certify that they do not have any taxable income and their monthly payments will be lowered to $0 per month for the next year.

Those with reduced income will have to do a bit more work.

Documenting a Change in Income

Borrowers who have a change in income will get the following instructions:

This is how your document your income:

- Documentation will usually include a pay stub or a letter from your employer listing your gross pay.

- Write on your documentation how often you receive the income, for example, “twice per month” or “every other week”.

- You must provide at least one piece of documentation for each source of taxable income

- If documentation is unavailable or you want to explain your income, attach a signed statement explaining each source of income and giving the name and the address of each source of income.

- Copies of original documentation are acceptable.

- The date on any supporting documentation you provide must be no older than 90 days from the date you sign this form.

Self-employed people will have a hard time providing this sort of documentation, so a call to the loan servicer may be necessary. In most cases, a letter explaining income and expenses will work.

Borrowers have the option of mailing the form to their loan servicer. However, the fastest way may be to upload the supporting documentation directly to the loan servicer. Call your loan servicer for details and procedures.

When Can Monthly Payments Be Reduced?

Borrowers can recalculate IDR payments whenever there is a drop in income, such as a pay cut or job loss.

Another possible reason would be if a borrower has a child and changes the number of dependents.

Borrowers who have their Adjusted Gross Income (AGI) drop due to increased retirement contributions or other deductions may also want to recalculate their monthly payments. These borrowers should be sure to utilize the IRS link to give studentloans.gov the most recent tax information available.

Final Thoughts

While there isn’t a “bug” with the current online application system, it is definitely more confusing than what it needs to be.

In the current system, borrowers have to click on the link to connect with the IRS even if they do not want to use the most recent tax return.

Hopefully, we will receive comments from borrowers in the comment section indicating that this particular issue has been fixed and can take this article down in the near future.

Can you discuss the scenario of a Married, Filing Jointly couple, both with federal student loans, each on their own REPAYE, where spouse has lost their job? My husband and I are in this boat right now. I’ve lost my job, and want to have my payment changed. Do I still go through this same process and select it all as you have said, and then when he has to do his part (they make the spouse sign to complete the process), he’ll select to actually upload our most recent tax return and they’ll pay attention to only his portion of income but have changed mine to 0…? Does that make sense, and am I thinking this through the right way? Thank you for any help you can give!

This is a great question Morgan. If your husband uses your most recent tax return, your payments may not change. He may have to use a paystub instead of your tax return.

I’d suggest talking with your loan servicer about the best way to document your income in this situation. Make sure they understand your exact circumstances and concern. This may require a few calls. They may want you to write a letter along with your application to explain the circumstances.