This afternoon the Department of Education quietly changed the policy on one-time forgiveness for borrowers with FFEL program loans. The abrupt shift is yet another blow for FFELP borrowers.

While the news is undeniably bad, all hope is not lost. There is a chance that borrowers with commercially-held FFELP loans may still yet get $10,000 or $20,000 of loan cancellation.

This article will explain what changed, why it changed, and what borrowers impacted by the policy should do. Finally, I’ll cover the few nuggets of hope in an otherwise lousy news day.

The Policy Change for FFELP Loan Borrowers

Before today, the official policy of the Department of Education was that privately-held FFELP loans could qualify for the one-time Biden Forgiveness Program.

Under the new policy, these borrowers cannot qualify for loan forgiveness, and they do not have a path to forgiveness.

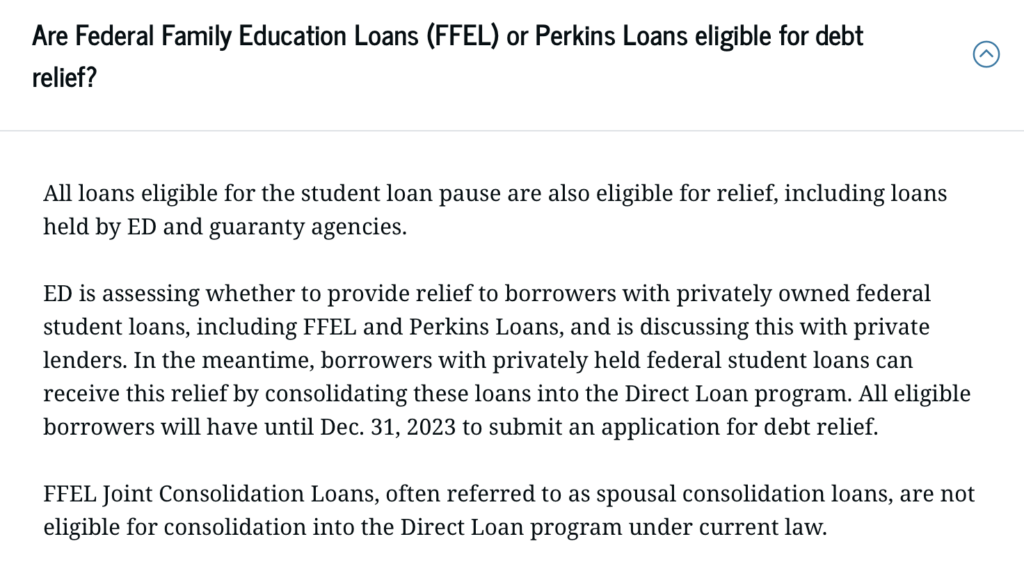

Here is a screenshot from yesterday:

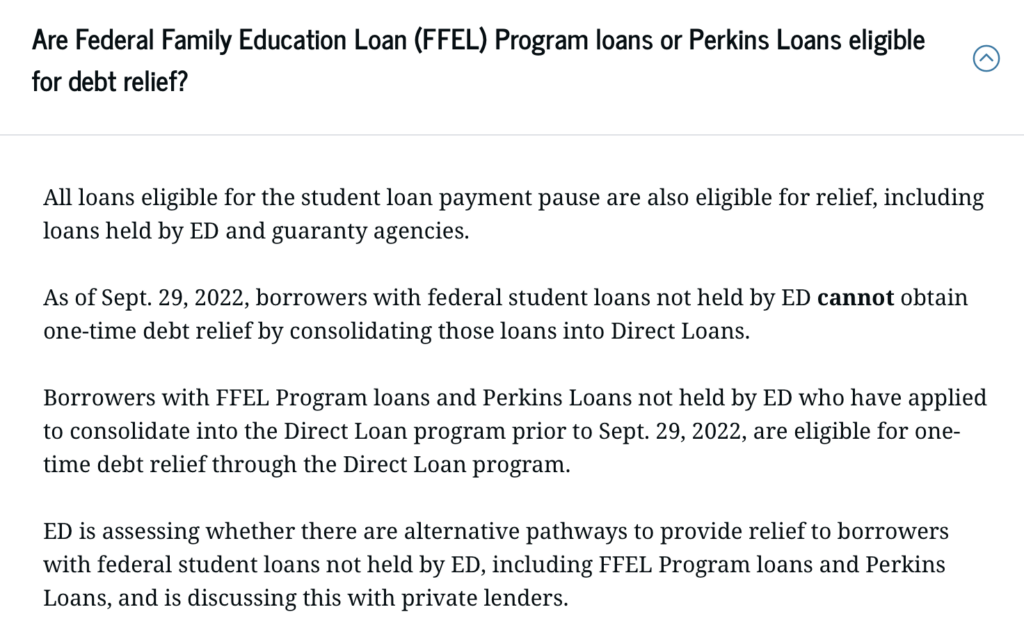

Today, the language was changed to the following:

While there are many jarring aspects of the policy shift, imposing a deadline without first announcing it seems especially cruel.

A Special Note for federally-held FFELP Borrowers: If you have federally-held FFELP loans, this policy change does not apply to you. Borrowers with federally-held FFELP loans remain eligible for up to $20,000 in loan forgiveness.

If you are unsure if your loan is federally held, the easiest way to tell is through the payment pause rules. During the Covid relief, if you were not required to make payments or charged interest, your loan is federally-held. If you had to make payments, your loan is privately or commercially held.

You can also verify the status of your loan by accessing the database on studentaid.gov.

The Explanation for the Abrupt Policy Change

Today, six states filed a lawsuit challenging Biden’s one-time loan cancellation policy.

The lawsuit raised several arguments, but the one that led to today’s policy changes came from the state of Missouri, home of MOHELA. MOHELA was created by the Missouri legislature in 1981 and operates as a quasi-governmental entity. Notably, MOHELA also is responsible for some commercially-held FFELP loans.

According to the complaint, “[t]he consolidation of MOHELA’s FFELP loans harms the entity by depriving it of the ongoing interest payments that those loans generate.”

In other words, if borrowers consolidate their privately-held FFELP loans, MOHELA loses money.

—

The significance of this detail goes back to the legal concept of standing. Anyone bringing a lawsuit must meet specific requirements to have the court hear the case. If those requirements are not met, the case gets dismissed.

Turning to student loan cancellation, you can’t sue because you don’t like the law or think it is a waste of money. Standing requires an injury to the party bringing the lawsuit. Some have argued that no party would have standing to challenge a one-time student loan forgiveness program.

If privately-held FFEL loans are eligible for forgiveness by consolidation, the state of Missouri has a very strong standing argument. If the lawsuit clears the standing requirement, a federal judge could prevent Biden’s entire forgiveness program — not just the FFELP forgiveness.

The actions of the Department of Education today are a desperate attempt to ensure that a judge doesn’t block Biden’s forgiveness program. It is the legal equivalent of cutting off a limb to save the body.

Steps for FFELP Borrowers to Get Forgiveness

Unfortunately, there isn’t a quick fix to this situation. You can’t go back in time and submit an application to consolidate yesterday.

The best bet for impacted borrowers is to apply pressure on the federal government. Go to studentaid.gov and file a complaint. Call your elected representatives and let them know that you are unhappy with the FFEL policy change.

The timing of the original student loan forgiveness announcement was clearly aimed at making voters happy before the midterm elections. If people show their outrage over the reversal, it should inspire action.

Right now, negotiations are likely happening between the federal government and FFEL loan servicers. Department of Education lawyers have to figure out a way to cancel FFEL loans without hurting FFEL loan holders. The more pressure voters apply on their elected representatives, the more likely it becomes that a deal is reached to avoid the lawsuit.

Now is the time to get loud and be heard.

If that all fails, it is also possible that the sudden change in rules leads to a borrower lawsuit against the Department of Education. If that day comes, this article will be updated accordingly.

Outside of the political front, there are a lot of loan management decisions for borrowers currently stuck with FFEL loans. Some borrowers may still want to consolidate their FFEL loans.

The Hope for FFEL Forgiveness

The Department of Education statement today makes it clear that they are trying to resolve the FFEL issue:

Our goal is to provide relief to as many eligible borrowers as quickly and easily as possible, and this will allow us to achieve that goal while we continue to explore additional legally-available options to provide relief to borrowers with privately owned FFEL loans and Perkins loans, including whether FFEL borrowers could receive one-time debt relief without needing to consolidate.

Without question, this is a setback. However, there is still time for positive developments.

Additionally, the Biden Administration’s track record is pretty good when it comes to helping FFELP borrowers. The Limited Waiver on PSLF allowed many public servants with FFEL loans to get the credit they deserved. Likewise, new legislation will help borrowers with FFELP Spousal Consolidation Loans qualify for IDR repayment and PSLF.

Today’s developments are a clear sign that somebody dropped the ball. However, there is a track record of fixing things for FFELP borrowers and a stated desire to fix this particular issue.

If FFELP borrowers make enough noise about getting misled and excluded, it could inspire yet another fix.

Hi, Michael. Thank you so much for this announcement. I just found this news now at the last hours (so to speak) before tomorrow’s deadline.

I have three loans that are FFELP, two of which are from grad school and one of which is a Direct (FFELP) Consolidation loan from my undergrad. I am applying for PSLF and first found out that the 120 payments don’t start getting counted until after I consolidate these and make payments on the new loan, and now I am hearing this news.

I was going to leave out the last loan as it was for my undergraduate education and I was hoping it would be forgiven by the federal debt relief program, but it sounds like at this point I should just consolidate all three and try to get them knocked out (or down, at least) by PSLF. Would you say that’s correct?

Many thanks for your generous help here in understanding these arcane labyrinthine rules.

Great question Claire. The one-time forgiveness program is currently held-up by one of the lawsuits, but the Biden Administration sure seems optimistic that they will ultimately win. I think is probably a question of risk weighing. How confident are you that you will soon get PSLF? How confident are you that the one-time forgiveness program actually happens?

The one thing that is certain: you don’t want to miss the 10/31 deadline for your FFELP loans.

What is the 10/31 deadline? I was under impression my loan consolidated in 2001-2002 under Sallie M was federal and eligible. I rece Pell grant. Now what? I get no assistance because elections over?

The 10/31 deadline that you may have heard about is in reference to the limited waiver on PSLF. That deadline has nothing to do with the one-time forgiveness program described in this article.

As of right now, the courts have struck the one-time forgiveness program completely. However, it is currently being appealed by the Biden administration. We may not know the final result for a while.

Hello!

I was considering applying for PSLF. I have FELP loans held by Navient. From 2004-2013, I was a contractor for a division within the US Dept. Of Health and Human Services. When contacting the contractor company for employment verification, the HR Director informed me that the company does not qualify because they are contractors and therefore would not confirm employment verification. This company is currently listed as “undetermined” in employer search tool. During my employment the division certainly did public service work, but without employer vertification I cannot verify that I worked within public service and a majority of my public service employment years are with this company. I’m not sure what to do at this point. Does this disqualify me for PSLF? I do not want to consolidate my FELP loans without a clearer picture on whether or not I can still qualify for PSLF after receiving this information. Any thoughts would be helpful. Thanks.

Based on the information you have shared, I have a few thoughts.

First, the work between 2004 and 2007 almost certainly won’t count. The PSLF program was created in 2007, and work done before that date doesn’t count towards PSLF.

Second, government contractors usually don’t qualify for PSLF, but there is at least one exception to the rule.

Third, this is all a moot point if your employer refuses to complete an employer certification. They have a huge incentive to certify people as it can be a great recruitment tool… but if they have determined they are not eligible and therefore refuse to sign, you might be out of luck.

This is actually what I thought. Thank you for the confirmation.

I am in a similar situation as Darren. Do you need to consolidate the FFELP loans into an IDR repayment plan or can you still get the IDR count update if you consolidate to an extended standard repayment plan through ED? Thanks!

If you are working towards IDR forgiveness, it doesn’t make sense to sign up for the extended repayment plan because those payments definitely won’t count.

Where exactly do we go to file a complaint on the studentaid.gov website

It’s time to get loud

I was one to help Biden get elected and am seriously reconsidering party alignments at this point

The Feedback Center on studentaid.gov is what you are looking for.

I didn’t find out my commercially held student loan would need consolidating to qualify until the last week of Sept. When I wanted to call to do this, I had no cell service from Sept 27- Oct 3 due to Hurricane Ian. I called as soon as I could and was told the deadline was the day after the hurricane! I not only lost a home, but I also lost hope of this.

This entire situation is horribly unfair to FFEL borrowers. I really hope the Department of Education makes things right for borrowers such as yourself.

It’s ridiculous that any/all FEDERAL Family Education Loans are not included in FEDERAL student loan debt relief.

Hi Michael, Student Loan Sherpa. I had 10 years of qualifying public service and paid my graduate student loan under a non-income driven plan. Applying the PLSF Waiver application now. Need to consolidate my FFELP from Navient (current servicer) to a Direct Loan (Mohela as servicer). Which repayment is eligible? Does it have to be an income driven plan (like IBR, ICR, REPAYE, or PAYE)? Also, would I be able to chance the plan later on after the consolidation (e.g., family #’s or income changes)? Thank you!!!! Mohela’s wait time is 270 min, 120 min, and today 190 min. I really hope you can help!!

If you are working towards PSLF, you will need to sign up for an Income-Driven Repayment plan… and based on what you have said, you definitely don’t want to miss the Limited Waiver on PSLF deadline which is 10/31.

I know hold times are brutal right now, but if you have a question about your individual loans or need your servicer for help, you will have to wait it out.

I’ve been making payments on my federal loans administered by Nelnet for over 20 years now. I had zero idea who actually “held” them. I found out today that they are indeed federal (Stafford) loans not held by ED. There wasn’t an ED option 20 years ago when I consolidated them and set up auto debit at 3%. I have never stopped paying. Now I find out I’m not eligible for forgiveness because they are labeled FFELP? Why didn’t the government (ED) just buy my loan? I had no idea I needed to consolidate an already consolidated federal loan, just to switch who owns it.

And here is another wrench in the puzzle…I received a Pell Grant in 1998 as an undergraduate. Does this now mean I am eligible? Or not eligible? I mean I only have $15,000 to go, but $$$ is $$$

The Pell grant would mean that — if eligible — you would qualify for $20,000 instead of $10,000. However, as things stand right now, borrowers with commercially-held FFELP loans don’t qualify at all.

Hopefully, this changes soon.

Should I switch the loan over to ED even though it is past September 29th? The rate will still be the same. The only difference is the term. Or just wait a bit to see how this shakes out?

If the rate stays the same, there are a couple of other advantages to consolidating now. You can take advantage of the Limited Waiver on PSLF if you work in public service, and you can also take advantage of the IDR count update.

Confused, if I fill out an application for relief and get refused. If they change the eligibility requirements, will I be able to re-apply at a later date.

Its hard to say Harold. They don’t have a policy on that situation right now. Its possible that if you get refused now, and they change the rules, that they automatically review your application in light of the new rules. All we can do is speculate at this point.

My wife and I consolidated our FFELP loans to a non-profit loan servicer called Granite State Managment & Resources in NH. This was almost 20 years ago. Combined, we still owe a little over $6000. I can see the balances for both of our loans on the StudentAid.gov website in the My Aid section. Does this mean we are still eligible to have the loans cleared since we meet the income requirements for the full amounts to be forgiven? We have our own balances and StudentAid.gov logins since we refinanced before getting married.

Is your combined debt in a joint consolidation loan or spousal consolidation loan? What type of loan does studentaid.gov say that you have? During the payment and interest freeze, have you been required to make payments?

We have our own loans. No spousal loans. We never stopped paying on them because when I called GSMR during the pandemic about the loan payment freeze, they didn’t say anything about me being able to stop them and also stop the interest from accruing. We’re months ahead on the payments due to paying a little more than we need to each month, so even if we did stop paying them, we wouldn’t owe a payment until next year.

It sounds like you have FFELP loans that were impacted by the recent policy change described in this article. Right now it isn’t looking good, but things can change quickly, especially if enough people speak up.

I just discovered the Sept. 29 deadline when I went in to consolidate my FFEL today. Wondering if should still

proceed with consolidating or if that might somehow make me fall into a different gap.

Its hard to answer that one definitively, Lola.

Any chance you will be pursuing PSLF or forgiveness via an IDR plan? If so, consolidating still probably makes sense.

Figuring out the Biden forgiveness question for people with commercially-held FFEL loans is tricky. It really is a moving target with many unknowns.

+1

I wish I’d seen this about reconsolidating before this curve. I was waiting for the October information on my FFELP. 🙁 I’ll have to try for the PSLF and see what happens…

I was literally planning to do all of this application process for the direct consolidation of my FFLEP as of today Fri, before the end of Sept. I was on huge work deadlines all month and did not have the mental space to figure it all out, and there was little to no clarity it was required to consolidate or not–plus no clear info what would happen to the interest rates on the remaining loans after doing it. It’s certainly hugely unfair that they did not give us a clear heads up there was a deadline looming, and to just brush it under a rug quietly is sh*tty. Frankly folks with the FFLEPs have been given NO specific information or details about the options from the ED or the loan servicers ever since pandemic relief started, it is every man or woman for themselves to hunt info down– yet the FSA site is fairly VAGUE about all of it.

Forgot to ask — even tho there is not currently the option to qualify for the debt relief as of right now, should we still consider applying for a direct consolidation loan for our FFLEPs, if they do not adversely affect our interest rates, and MAYBE they will reconsider these folks that apply on or after 9/29

That’s a tough question to answer. It is possible that consolidating now is a mistake, and it is possible that consolidating now is the best option to get forgiveness.

However, I will say that consolidation of FFEL loans right now is a great idea if there is a chance you will qualify for PSLF or if you want to take advantage of the IDR count update.

Even tho the cut-off to consolidate the FFLEPs was prior to 9/29/22 — should we still go ahead and do a direct consolidation loan now? Doing so does not affect our APR, correct–it just averages it?

Also is there any way to qualify “extended” payments made to FFLEPs into a income-driven repayment plan under the direct consolidation program–so that past payments qualify toward the 25 yrs for the income forgiveness? Is there a max income limit to qualify for that program? I think my servicer, Navient, did not provide any information regarding the best plan for me to be on and I have been in repayment nearly 20 yrs now, and still owe $35k.

It is possible that consolidating now does increase your interest rate. Consolidation usually uses the weighted interest rate of the included loans (meaning no change). However, some of the commercially-held loans have unique interest rate terms that a borrower would lose by consolidating.

As for as getting previous payments to count towards IDR forgiveness, consolidating now is an option due to the IDR Count Update/Waiver.

Finally, there isn’t an income limit for IDR plans. The only issue is that at a certain point, IDR stops saving you money, because it is based on a percentage of your income.

Thank you for posting the hope for the borrowers. I am going to raise a complaint though as the language was unclear.

I appreciate the kind words, Nicole. I don’t want to give anyone false hope, but I genuinely think that there could be a path forward for FFEL borrowers. Each compliant and call to Congress moves the needle.

It seems this lawsuit argues that the student loan forgiveness program incentivized FFELP borrowers to consolidate their loans with the Department of Education. That may be partially true, but these borrowers were free to do so even before the forgiveness was announced. How can private borrowers prove “harm” when borrowers were only availing themselves of something that they were legally allowed to do? Seems like a flimsy argument. There are benefits of consolidation outside of forgiveness and some FFELP borrowers might have consolidated even if they weren’t eligible or if forgiveness wasn’t appropriate in their personal case (e.g., higher interest offset forgiveness amount). The forgiveness announcement made them realize these benefits and thus they consolidated.

In fact, it can be argued that many FFELP borrowers were unaware of the benefits of consolidation with DoE because the private borrowers did not properly inform FFELP borrowers of the benefits of consolidation during the COVID-19 payment freeze.

Every single one of your arguments is 100% right Scott. In fact, they might be a winning argument in the lawsuit.

However, I think the government strategy here is to move forward with their strongest case (direct loans and federally held loans), and then circle back to the others once they have secured the win for the majority of the debt they are looking to cancel.

How is there not a major argument that the future value of the $$ of the paid loan is worth less than the current value if paid now?! With inflation the way it is, they are better off getting paid now. The future value of the loans is ever depreciating…

That’s an interesting point, Sara. I suspect that the FFEL companies would argue that the loans are still profitable for them, even with the current inflation.

THIS!! No information from the lenders, or the government, to the FFLEP loan holders, NONE, to suggest that we should -or- could consolidate, and should have as soon as the ED froze payments and interest. Yet again, the little people get swept away into the murky waters of big banks and their greed.

QUESTION IS… if we did not yet apply for the direct consolidation for the FFLEP loans, should we still wait, or should we go ahead now, despite being after this arbitrary cut off, that I think could also be challenged in court??

I’m curious about the language. It says, consolidation applications after 9/29 are not eligible, right? Or, applications submitted before 9/29 are still eligible?

The language on the student aid website says applications submitted prior to 9/29 are eligible. Based on that language, if you submitted on 9/29 it won’t be eligible. That said, this is a really fluid situation and things may still change.

I literally applied for consolidation today prior to this announcement because it was on my To Do list in Outlook. I relied on the governments guidance not to rush to consolidate and know a lot of other people that did the same. This one stings and it doesn’t really make much sense. How are these same FFEL loan holders not harmed by the people that applied for consolidation before Sept. 29th?

You are 100% right Drew. I’ve heard from a couple of people that the language wasn’t changed until around noon on 9/29, meaning you may have submitted your application before the rule changed.

Given that this is an evolving situation, I’m hopeful that you will eventually qualify for the one-time forgiveness, but as things stand right now, many people such as yourself are definitely harmed by the sudden rule change.

Thanks Michael. I just don’t understand why they think this is going to somehow undercut MOHELA’s standing argument. Aren’t they harmed by the pre-Sept. 29th consolidations enough to pass the standing requirements? Is it just an optics game as to the size/degree of harm? If so, I think it’s a pretty stupid policy change politically speaking because I don’t think this lawsuit is going to get tossed because of this pivot.

That is an excellent point. I can’t say for certain, but because the government never said it was necessary to consolidate FFEL loans to qualify for forgiveness, they can argue that they never induced any borrowers to consolidate their FFEL loans. (Notably, the option to consolidate FFEL loans has always existed for these borrowers)

It’s also possible that the new policy helps the government case from a preliminary injunction standpoint, but I’m just speculating.

I believe a thank you is in order. When this loan forgiveness was first announced, I was unsure what it meant and went on a google search to try to find info. I came upon this blog where I believe you urged those of us with privately held loans to consolidate under a Direct Federal loan ASAP. This evening, I received a letter from the DOE stating my direct consolidation application had been processed. Now I see this reversal news. If I’m understanding correctly, I should be eligible (as of now). If I do qualify, it will be thanks to your advice. So thank you.

Thanks for the kind words John. I’m glad to hear that it worked out for you. Because you applied to consolidate long before today, you should be fine. It might be a while before it gets finalized, but the application date is the day that matters.

I just wish I pushed this advice harder. A couple of weeks ago, the Department of Education released new information urging borrowers not to rush to consolidate, and I backed off the ASAP advice.

From a legal standpoint, I get why the Department of Education made the changes they did, but this is a really bad look for them. Hopefully most borrowers jumped on the consolidation option right away like you did, but I fear you might be in the minority.

Yes, thank you for the info. I was compiling info considering direct consolidation of my privately-held FFEL consolidation loan. When the DOE said “don’t rush”, I stayed up till 4 am applying and currently have the application processing. Seems the direct consolidation option just turned into a direct constellation option; where the stars, the sun, and the moon have to line up just right to happen.