It is easy to understand why there are so many student loan-related scams. Student loan repayment is a complicated maze of federal rules and regulations. Finding accurate information or advice is often a challenge. Add in the stress of massive debt, and you create an easy mark for a scammer.

The purpose of this article is to help borrowers identify and avoid student loan scams. Much of the advice contained below comes directly from the Federal Trade Commission (FTC) or the Consumer Financial Protection Bureau (CFPB). I’ve also included details on some of the types of scams I’ve seen over the years.

Calling Out Scammers by Name: I’d love to make a list of known scammers as a resource for borrowers. Sadly, a scary experience dealing with a scam company makes going that route especially difficult.

What Does a Student Loan Scam Look Like?

The most effective scams that I have seen create a sense of urgency with borrowers. Act now before the opportunity disappears.

For many responsible borrowers, a limited offer is worth investigating. If there is even a chance that the offer is legitimate, the potential savings would be enormous.

While the rules for student loans do change, it never happens quickly, and it never costs any money to benefit. All federal student loan programs are free to enroll. Additionally, paying for expert help handling paperwork is almost always a mistake.

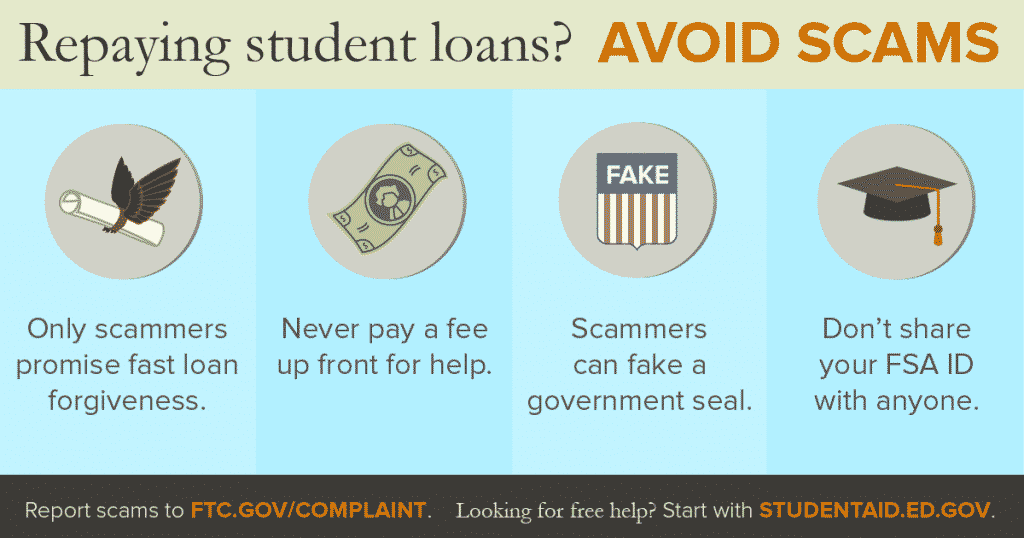

This graphic from the FTC best summarizes some of the telltale signs of a scam:

Lower Student Loan Interest Rates: Real or Scam?

The good guys and the bad guys both promise lower interest rates.

What is Legitimate – There are many student loan refinance companies that can actually lower your interest rates. Most of them work with both federal and private student loans.

The legitimate companies make money by offering lower interest rates to borrowers who are highly likely to pay back their student loans. These lenders pay off your existing debt with your old lenders. Then, you pay back the new company at, what is hopefully, a lower interest rate. The aggressive advertising, lower interest rates, and sign-up bonuses often trigger the “too good to be true” alarm for many consumers.

The best way to know you are dealing with a legitimate company is that good credit will be required. They will need your credit report to determine if you are a borrower who pays back your debt and can afford the loan.

This service is normally advertised as student loan refinancing, and there are many lenders in the refinance business. We have ranked and reviewed the nationwide companies offering student loan refinancing. Note that although some lenders received negative reviews from us, they are still legitimate companies. They just provide rates and terms we think could be better.

When a Lower Rate is a Scam – One of the biggest red flags to be aware of is when a company promises you lower interest rates and student loan forgiveness. You can get lower rates by refinancing your federal loans. However, those loans become private loans and lose eligibility for federal forgiveness programs. Alternatively, you can pursue federal forgiveness, but the government won’t be cutting your interest rate.

If everybody gets a lower interest rate, it is also probably a scam. Refinance companies only make money if they are smart in choosing their customers. If they pay off the loans for people who won’t pay back their debt, they will lose money.

Obama, Trump, or Biden Student Loan Forgiveness

Scammers love to advertise forgiveness programs associated with the current president. They try to benefit from the harsh political climate by appealing to a particular point of view.

However, it isn’t fair to say that all federal forgiveness programs are a scam. It has just been my experience that if somebody attaches the President’s name to the program, it is more likely to be fraudulent in some way.

What is Legitimate – Many student loan forgiveness programs exist for federal student loans. The most common are the forgiveness programs offered through income-driven repayment plans and Public Service Loan Forgiveness. There are also programs for borrowers in certain occupations, such as teachers and military personnel.

You can enroll in the legitimate programs directly through your federal student loan servicer. No special expertise is required. Although, researching and understanding the programs is very helpful for preventing errors. Furthermore, there is no cost to signing up for any of the student loan forgiveness programs. Federal law created these programs and are often a term in your student loan contract with the government.

Legitimate student loan forgiveness does not immediately wipe away all of your debt. It takes years to reach. It is a good idea for some borrowers, while others are better off aggressively paying off their debt.

Student Loan Forgiveness Scams – One of the biggest giveaways to a student loan forgiveness scam is a high-pressure sales environment. If somebody is aggressively trying to push you into a program that will erase your debt, it should be a red flag. Another huge red flag is any fees associated with the program. Again, student loan forgiveness is federal law, and signing up costs nothing. There should be no enrollment fees or monthly costs.

Another common red flag is when a company advertises a special relationship with the Department of Education. Such a relationship doesn’t exist. Student loan programs are open to all federal borrowers. No outside company can change your eligibility.

Finally, if you are working with a company that requires your FSA PIN, now known as the FSA ID, you are likely getting scammed. The Department of Education makes it clear that the borrower is the only person who should have access to this number.

You can achieve enrollment in any student loan forgiveness program through your federal student loan servicer. Any third party that tries to enroll on your behalf likely has bad intentions. At best, they are charging you money to fill out forms that you could submit on your own. At worst, they are flat-out stealing your money or your identity.

Student Loan Consolidation Scams

Student loans are consolidated when multiple existing loans are combined into one new larger loan. There are two types of consolidation. One is federal student loan consolidation, and the other is private loan consolidation. For many borrowers, student loan consolidation is a helpful or even necessary step. Unfortunately, there are also scammers advertising student loan consolidation services.

Legitimate Student Loan Consolidation – Many borrowers elect to consolidate their federal loans to gain eligibility for certain programs. For example, FFEL loans are not eligible for public service loan forgiveness, but they can be included in a federal direct consolidation loan and gain public service forgiveness eligibility. You can consolidate your federal student loans only directly through the federal government. This process can only take place using the Department of Education’s consolidation site.

Student Loan Consolidation Scams – If you are paying for this service, it is almost definitely a scam. Whether you are consolidating your federal loans for program eligibility or consolidating on the private market for a lower interest rate, the cost to you should be $0. Another red flag is if the company you are working for asks for your FSA ID or FSA PIN.

$0 Per Month Student Loan Payments

Like many other scams, the $0 per month payment scams start with a legitimate federal program and use it to take advantage of borrowers.

What is Legitimate – Federal student loans do have income-driven repayment plans. If you don’t have any income or your income is below a certain level, your monthly payment could actually be $0. It is also possible that the government could eventually forgive your loan. This is something you can do directly with your student loan servicer and requires no expertise or special knowledge.

When $0 Payments are a Scam – If you see advertising for income-driven payments, the odds are pretty good that it isn’t legitimate. Loan servicers and the federal government don’t spend money advertising these options. They have no incentive to promote these programs. They simply make it available for the borrowers who need help. If you are seeing aggressive advertising from a company offering $0 payments, it is a huge red flag.

Private lenders don’t have income-driven repayment plans. If you see an advertisement for this, somebody is probably trying to sell you something, and you probably don’t want to buy it.

Personalized Student Loan Consultations

There are numerous student loan “specialists” offering personalized advice for individual student loan circumstances. This is a gray area in the world of student debt.

It probably isn’t fair to label these individuals and companies as scams but, for many, calling them a reputable service would also seem like a stretch. I will add that much of what I’m about to say about these consultants is my personal opinion developed from years of researching and blogging about student loan issues.

The Cause for Concern – For most student loan borrowers, there shouldn’t be a need to hire a specialist. Unlike preparing your taxes, where programs and eligibility can be extremely complicated, student loans are something that any borrower can manage. It may be a bit confusing at first and take some time to sort out, but you can do it.

Hiring a student loan specialist is like paying someone to clean your house. Even though it isn’t a pleasant task, it is something that doesn’t require outside help. Not only does going this route cost money, but you expose yourself to theft. Plus, you will likely do a better job when you do it yourself because you are more invested. It might take you longer, but you won’t cut any corners.

Furthermore, when you do the job yourself, you learn and improve your monthly financial management. Time with student loan consultants is typically quite expensive. It can often require an ongoing monthly fee without any future services being performed. Ultimately, paying someone to manage your student loans instead of doing it yourself is a high-risk, low-reward option.

Having noted my concerns, I will say that there are professionals out there who charge a fair price and provide a quality service. The problem is that it can be nearly impossible to separate the quality services from those that you should avoid. If you are seriously considering going this route, take a very close look at the individual or company you have in mind.

When to Seek Professional Help – If you have been the victim of fraud or identity theft or you think you need to declare bankruptcy, it is probably time for expert assistance for your situation. In this instance, it is usually best to seek the advice of a local attorney. Student loans are federal, but many of the applicable laws vary by state.

Paying an attorney can be a costly option, but the rules and codes of conduct for attorneys are far more strict and closely supervised than for student loan consultants. It doesn’t guarantee that you won’t be duped, but it will dramatically reduce the chances.

Also, because several people have asked, I do not take on individual clients. I’m not looking for extra business by offering this guidance. I’m just trying to help people figure out when it is time to hire a professional.

Red Flags to Avoid

If the specific details covered so far don’t apply directly to your situation, the Consumer Financial Protection Bureau has some excellent general guidelines for identifying and avoiding student loan scams.

According to the CFPB, the following are all signs of a scam:

Pressure to pay high up-front fees. It can be a sign of a scam when a debt relief company requires you to pay a fee up-front or tries to make you sign a contract on the spot. These companies may even make you give your credit card number online or over the phone before explaining how they’ll help you. Avoid companies that require payment before they actually do anything, especially if they try to get your credit card number or bank account information.

Promises of immediate loan forgiveness or debt cancellation. Debt relief companies cannot negotiate with your creditors for a “special deal.” Federal law sets payment levels under income-driven payment plans. For most borrowers, loan forgiveness is only available through programs that require many years of qualifying payments.

Demands that you sign a “third party authorization.” You should be wary if a company asks you to sign a “third party authorization” or a “power of attorney.” These are written agreements giving them legal permission to talk directly to your student loan servicer and make decisions on your behalf. In some cases, they may even step in and ask you to pay them directly, promising to pay your servicer each month when your bill comes due.

Requests for your Federal Student Aid ID. Be cautious about companies that ask for your Federal Student Aid ID. Your FSA ID — the unique ID issued by the U.S. Department of Education to allow access to information about your federal student loans — is the equivalent of your signature on any documents related to your student loan. If you give that number away, you are giving a company the power to perform actions on your student loan on your behalf. Honest companies will work with you to develop a plan. Further, they will never use your FSA ID to access your student loan information.

A Couple Final Tips from the Sherpa

I once received a call from a student loan company that was going to fix my student loans. The glaring red flag was the fact that they didn’t even know my name. If you call me to offer a service and don’t even know my name, I know you are a spammer. Enough Americans have student loan debt that some scammers just call every phone number they can.

However, I’ve received mail from companies that had detailed information about my student debt situation. After some investigation, I determined that they were scams attempting to charge me for free federal student loan programs. The lesson: companies that have your loan information on file may not be legit. To this day, I have no idea how the scammers knew about my debt balance.

Finally, calls, texts, emails, letters, and ads about brand new laws and special programs from Congress are almost always scams. Any new student loan program from the government gets a ton of attention. These programs are easy to verify via a quick Google search. Don’t ever assume that some company has special access or information.

A loan relief scammed me in 2017. He used tactics that scammers use to lure a people in to believing they were getting their student loans canceled and the $498.99 fee was worth it. When I began telling him that I went to a for-profit school and that told me lies about transferring my credits to college to get my Nursing Degree and how I never got a job and was not allowed to take the state certification test. He just listened to my tone then jumped in to say I can go back to school in six months to get my degree under the Obama Student Loan Forgiveness Program as part of the agreement. I didn’t agree until months later because I worried about my son who was paralyzed by a hospital six months, and I was grieving the loss of five family members who died within six months. He slowed down from calling twice a week to once a month, until I finally agreed to pay the fee in June 2017. After he collected the payments he stopped calling So I thought my debt was discharged. It took a year before I learned I was scammed and I had a new loan with a company called Navient. Even then I did not realize that he deceived me into consolidating my loan into a new loan with an $84 a day interest rate until I turn 92 years old.

I am trying to get the loan voided because the loan is for a school never attended. The law says the terms of a signed contract is binding and all information must be true. Any information that is false can be subject to fines and possible jail time. Why would I agree to pay for a school I never attended. It is obvious that someone screwed up. I need legal advice to see if I could use the Stop Loan Debt Relief Scam Act signed into law in December 2020. This law makes it is a crime for a person or entity to gain financially or to get access to personal information by deceiving the person the records belong to. To my knowledge the law has not been used yet. I would like to argue that legislation was created in 2016 to allow students to use the Borrower Defense Rule that President Biden used to cancel student loans this year. Hopefully I can do the same under the law that passed last year.

I’m sorry to hear of your troubles. Some of these scams are truly awful.

You might also want to consider filing a complaint with the Consumer Financial Protection Bureau.

It might also be worthwhile to reach out to the Attorney General of your state.